Multiply Your Generosity with a

Donor Advised Fund

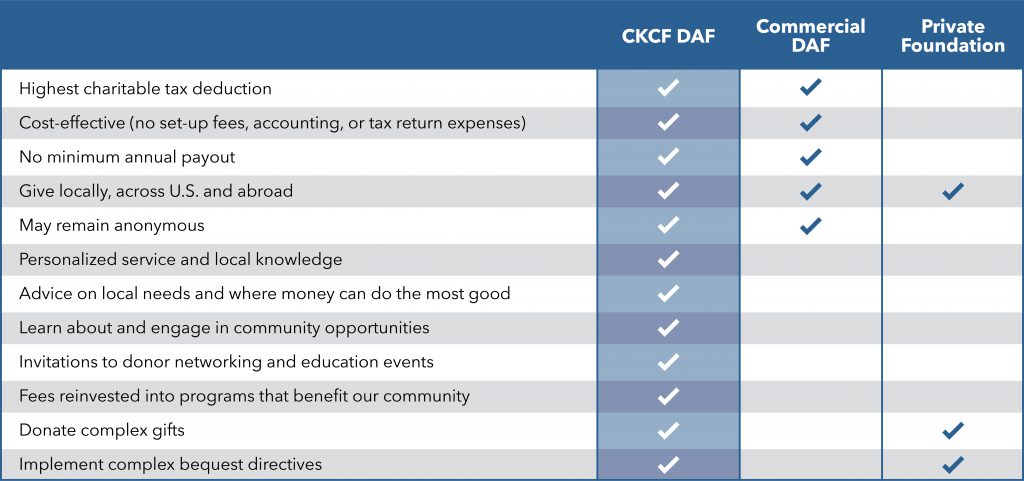

It’s never been easier to give back to your community and manage your charitable donations, thanks to Donor Advised Funds at Central Kentucky Community Foundation.

Think of a Donor Advised Fund as a charitable savings account: you contribute when it’s best for your taxes and then direct donations to qualified charitable organizations at a time of your choosing.

What’s even better? Your fund grows tax-free, boosting the amount you can give to the causes you’re passionate about. It simplifies giving and maximizes your charitable impact.

Learn More